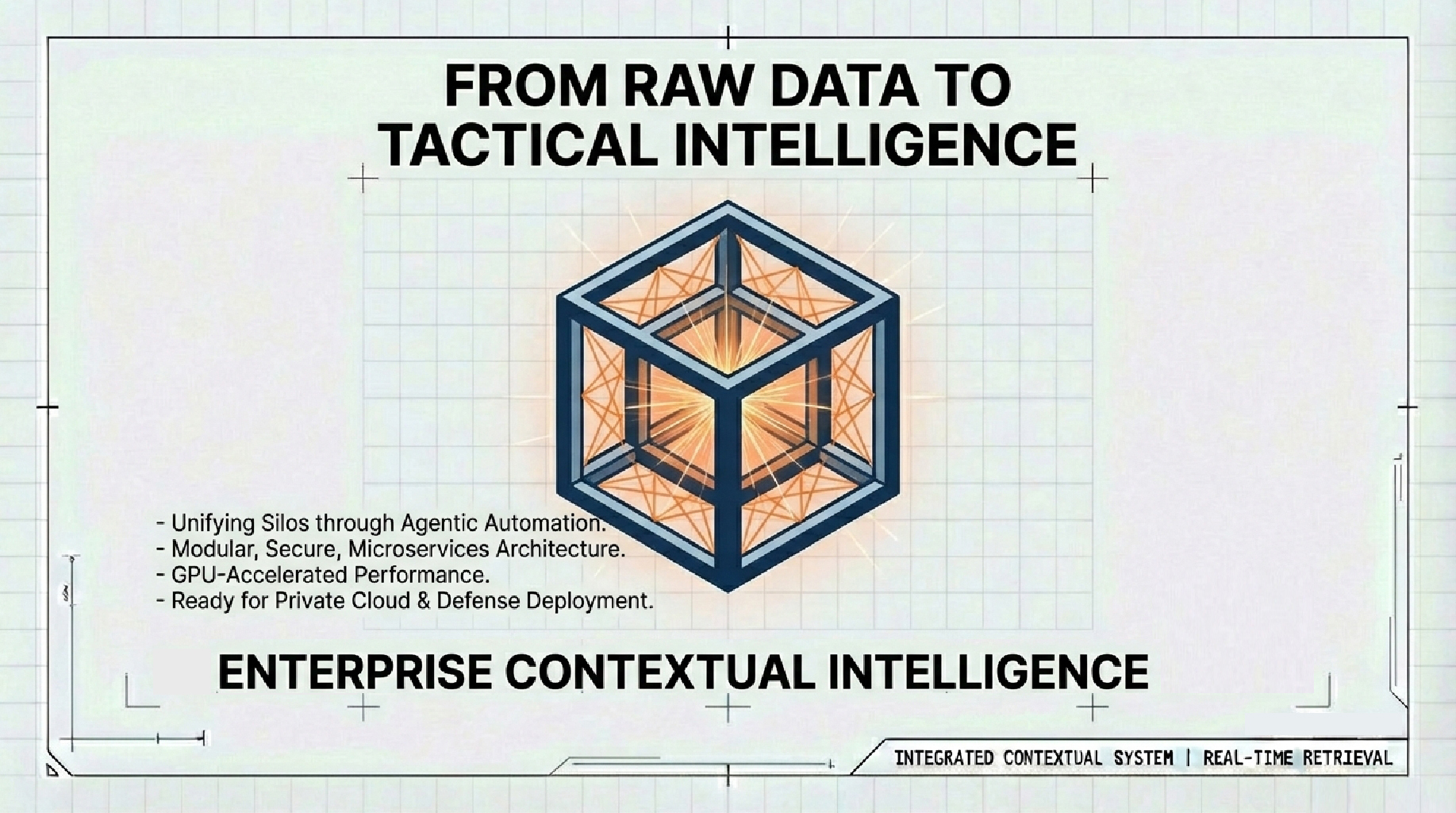

Tathya — Sovereign Agentic AI Multimodal Platform

Smarter. Safer. Sovereign.

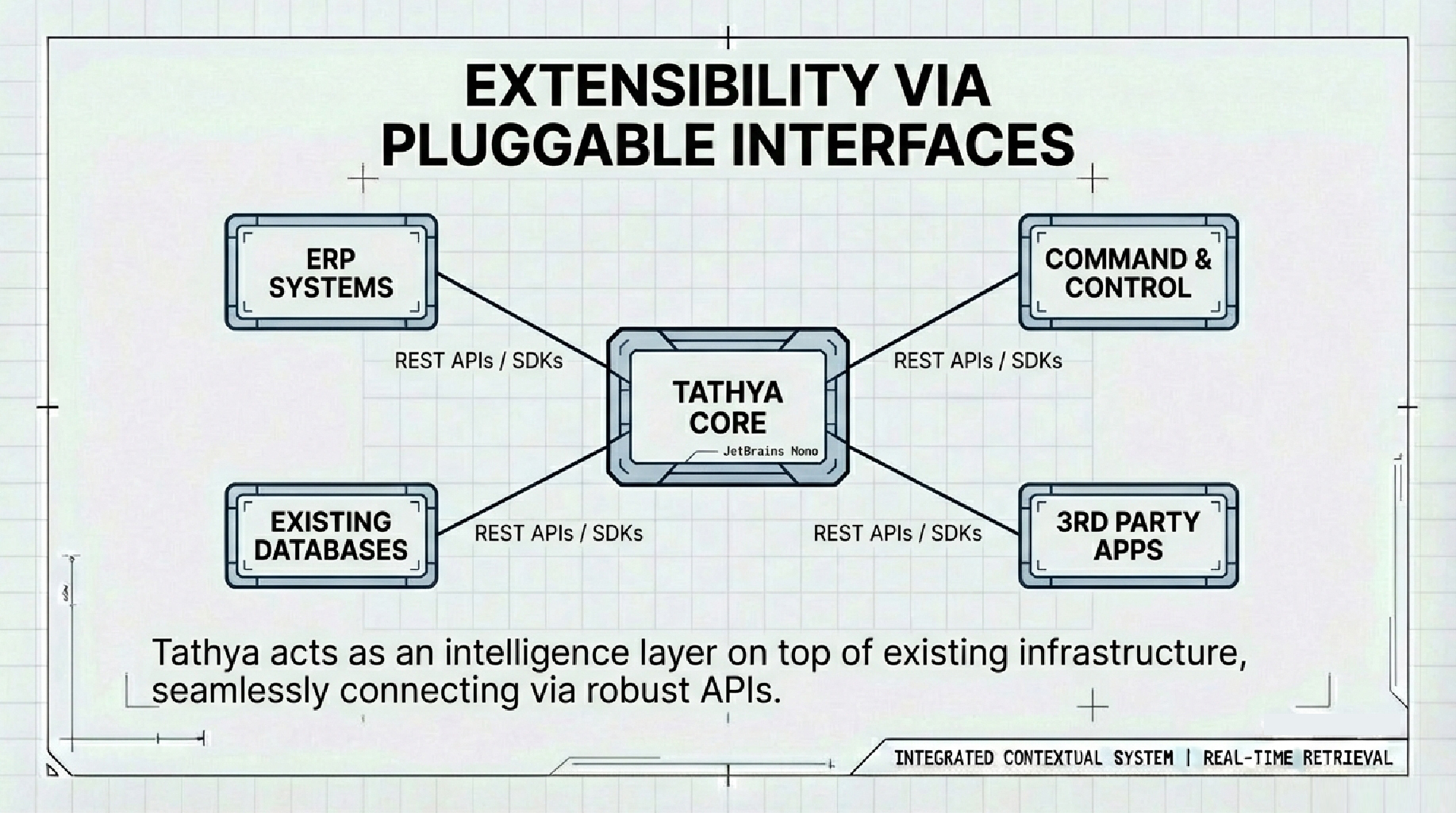

Tathya is an agentic, multimodal AI platform that turns fragmented enterprise data into precise, cited intelligence and ready-to-use drafts. Unlike cloud-dependent tools, Tathya is sovereign by design: it runs on-prem/air-gapped, as Private SaaS (single-tenant in your VPC or partner private cloud), or in public cloud where policy allows. It pre-processes millions of files to explainable intelligence in the languages your teams use every day.

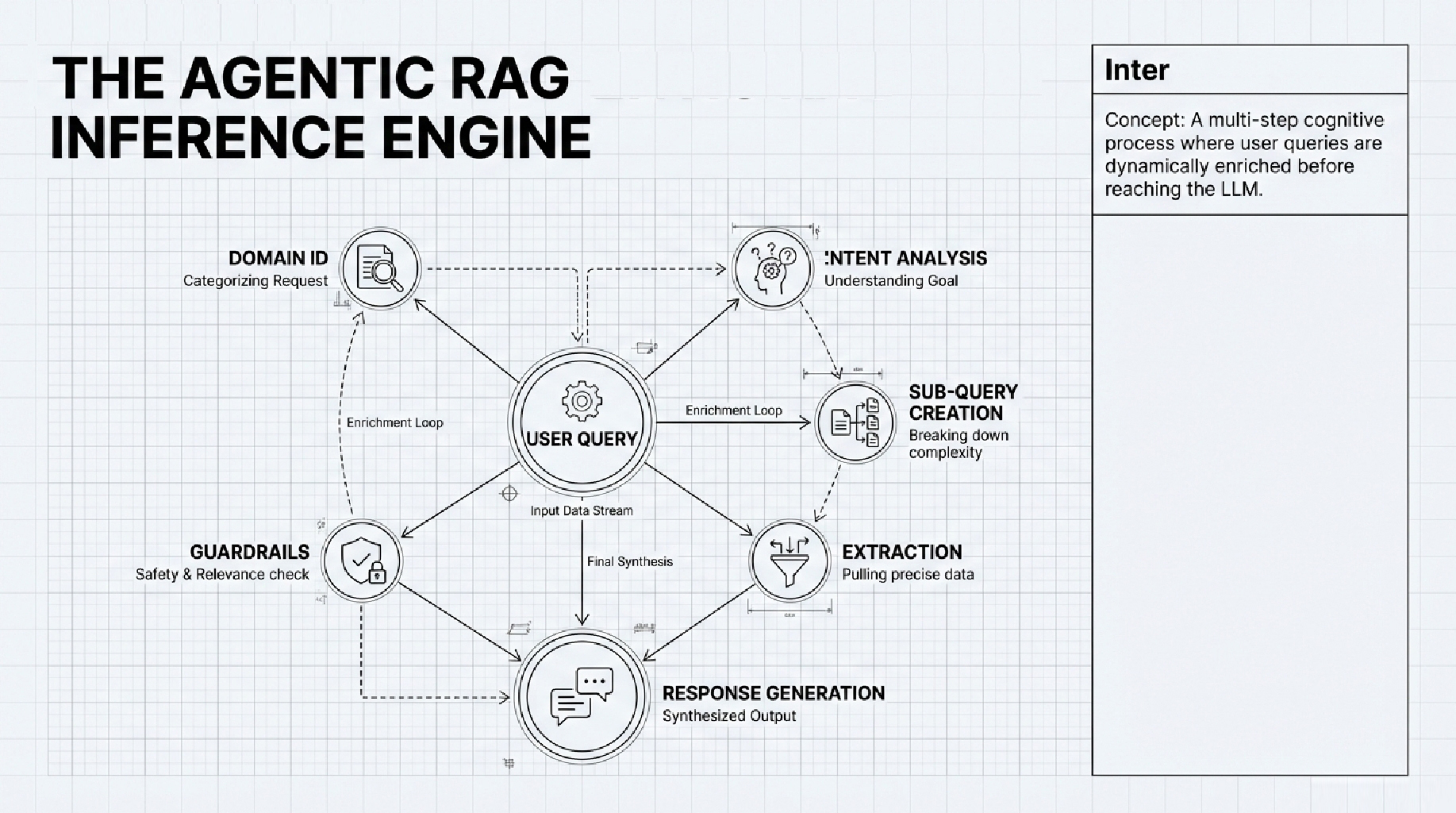

Agentic RAG, reimagined for enterprise

A coordinated swarm of agents—Understand → Plan → Find → Act → Explain—interprets intent, plans the reasoning path, retrieves grounded evidence, invokes tools (parsers, SQL, vision, code), and self-verifies outputs with citations and lineage.

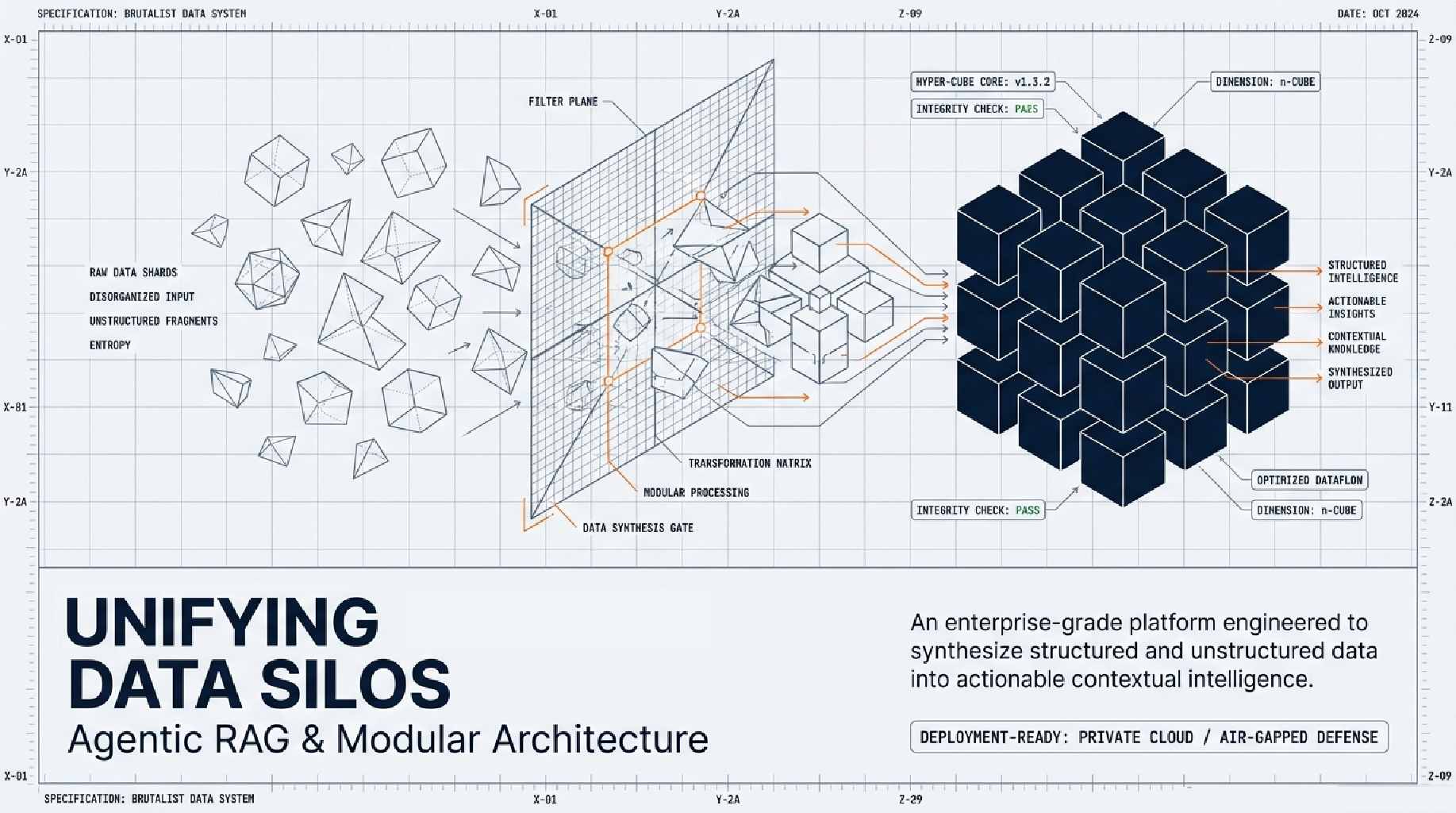

From Data Chaos to Decision Clarity

Data Ready → Decision Ready

Where typical systems analyze fragments at query time, Tathya prepares everything in advance, at enterprise scale. It connects to your estate, cleanses and harmonizes content, protects sensitive information, links related facts, and monitors freshness—so every answer starts from context, not chaos.

How it works

- Connects to file systems, portals, databases, lakes already in use

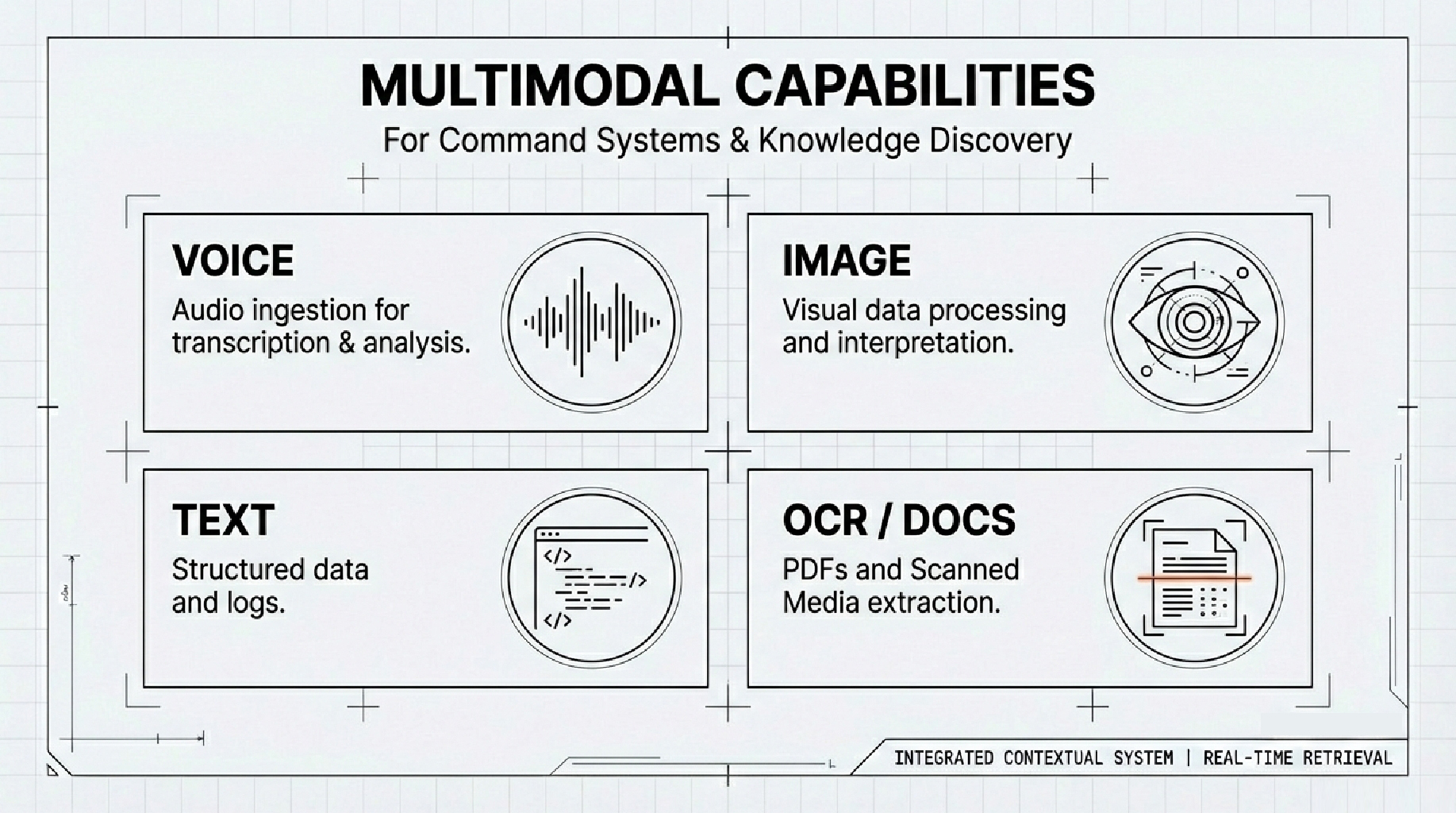

- Cleanses & harmonizes messy data; OCR/ASR, table & diagram parsing

- Enriches & links information (entity resolution, knowledge graphs)

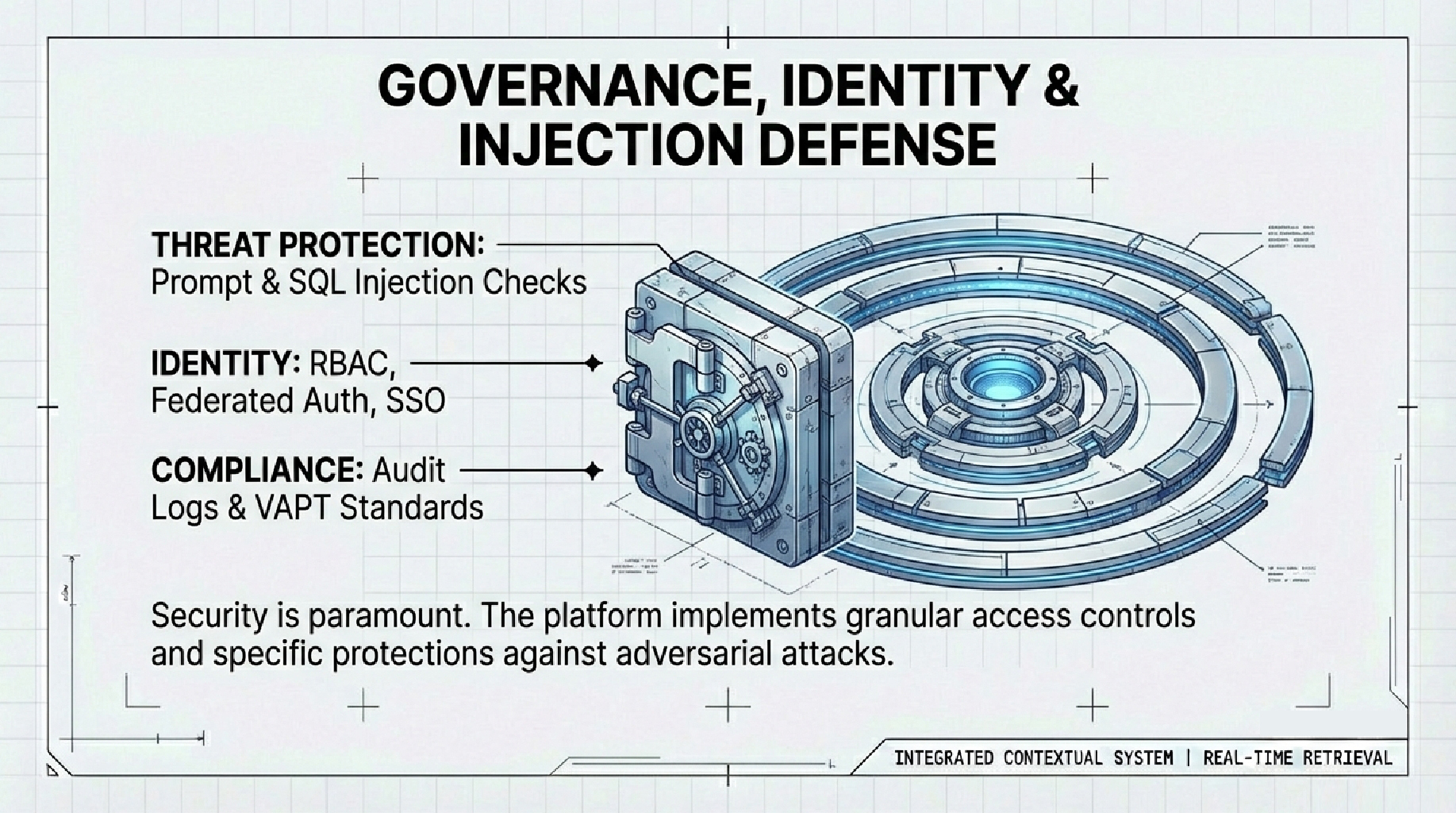

- Protects by design: PII redaction, RBAC/ABAC, encryption & lineage

- Transforms raw data into meaning (query-ready chunks and indices)

What this means for you

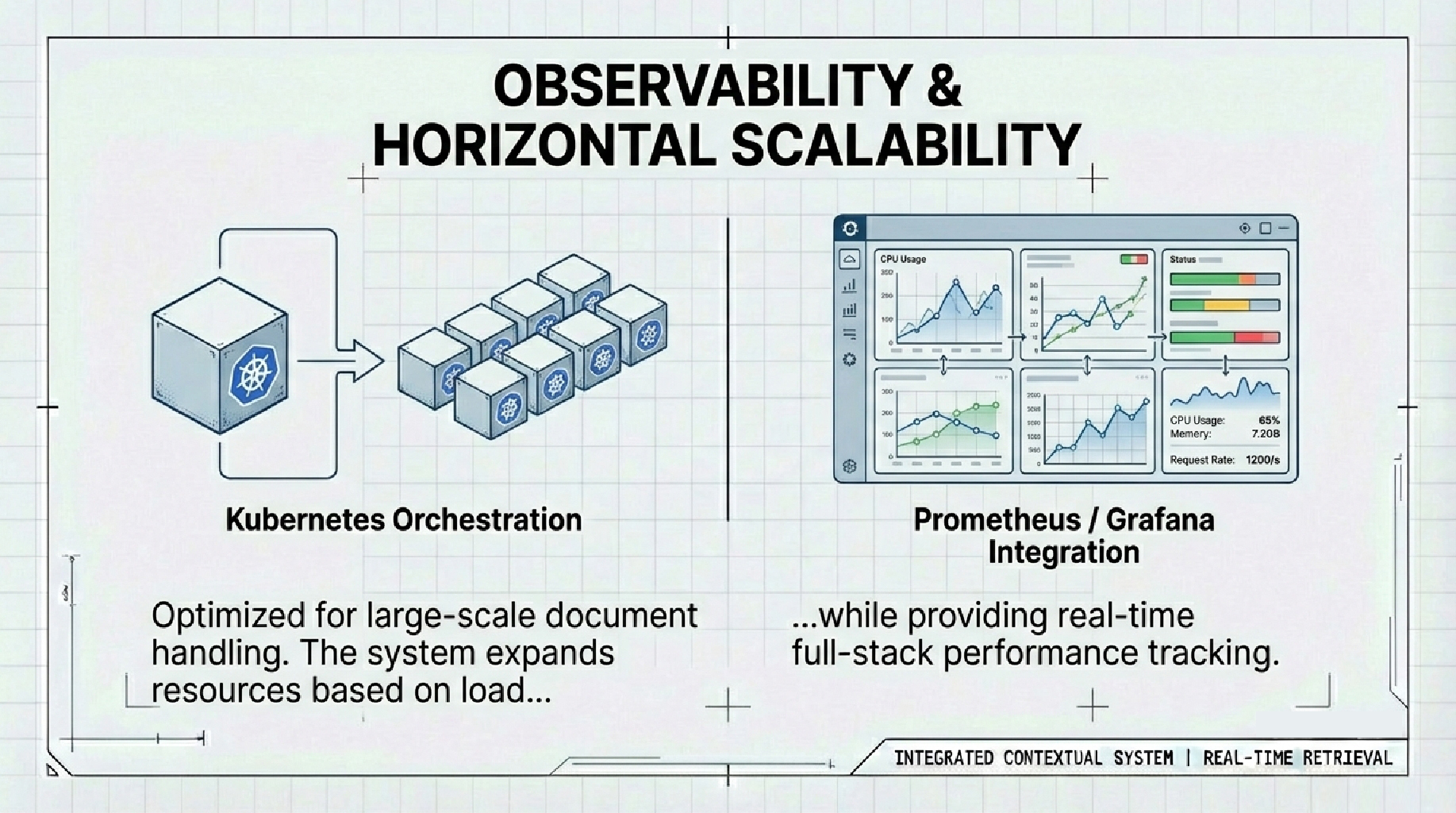

- Massive scalability: process terabytes locally

- Sovereign control: data never leaves your infrastructure

- Instant readiness: answers in seconds, not hours

Deployment

On-prem / Air-gapped Subscription (term license + updates + support, recognized as ARR). Absolute sovereignty.

- Private SaaS (single-tenant) in your VPC or our partner private cloud—keeps data isolated while shifting GPUs to OpEx (ideal if you don’t want to purchase large clusters; e.g., not every pharma wants to own 200+ H200s).

- Managed VPC/SaaS or public cloud where policy allows, for fastest time-to-value.

- Recurring levers: module packs (Document Gen, Compliance/Audit), user tiers, document/throughput bands, enterprise SLAs.

Technology

Defence & Security

Enabling rapid intelligence fusion, operational clarity, and mission-critical decision-making across defence and security operations.

Mission Timeline & After-Action Copilot

Challenge

Operational teams must assemble accurate mission timelines from orders, SITREPs, patrol logs, UAV/EO-IR footage—fast and with traceability.

Tathya Solution

- Fuses orders/SOPs/maps/UAV annotations into a linked timeline.

- Generates after-action reports with citations, stills, and redaction where required.

- Works air-gapped with digitally-signed update bundles.

Impact

50% faster time-to-first-brief · Repeatable templates · Higher decision confidence.

Sample Questions

- "Build a 24-hour SITREP for Operation X with source links and confidence levels."

- "Highlight deviations from SOP in last night's patrol and recommended mitigations."

Intelligence Fusion & Threat Briefing Copilot

Challenge

Analysts juggle HUMINT/SIGINT/OSINT feeds and images under intense time pressure.

Tathya Solution

- Intel Fusion Engine aggregates multi-INT; a reasoning agent drafts COA (Course of Action) briefs with risk scoring.

- Verifier enforces provenance (citations), caveats, and classification labels.

Impact

Faster threat assessment · Consistent briefing quality · Reduced analyst load.

Sample Questions

- "Produce a 3-paragraph threat brief for sector Delta; include COAs and risk score."

- "Compare Unit A timeline vs UAV notes; flag discrepancies and implications."

Route Risk & Patrol Pattern Analyzer

Challenge

Patrol routes and incidents recur; patterns are hidden across logs and imagery.

Tathya Solution

- Mines recent patrol logs and incident notes; overlays EO-IR cues.

- Ranks route risk with cited evidence and heat maps.

Impact

Proactive routing · Fewer incidents · Structured learning across units.

Sample Questions

- "Show route-risk overlays for Corridor K over 30 patrols; what patterns recur?"

- "What are top 3 contributing factors to ambush events last quarter?"

Defence Procurement — SoC/RFP Drafting Copilot

Challenge

Statements of Case and RFPs must follow mandated formats and reference specific clauses.

Tathya Solution

- Generates SoC/RFP drafts in approved templates; maps to procurement policy.

- Tracks changes and citations for audit.

Impact

Weeks → hours for drafting · Fewer compliance reworks.

Sample Questions

- "Draft an RFP for night-vision kits; align to policy clauses and add evaluation criteria."

- "List policy paragraphs that impact this SoC; insert citations."

BFSI (Banking, Financial Services & Insurance)

Accelerating customer intelligence, fraud detection, and regulatory compliance at scale.

Regulatory Intelligence & Policy Mapper

Challenge

RBI/SEBI updates are frequent; mapping to internal policy is slow and error-prone.

Tathya Solution

- Summarizes circulars; diffs clauses vs your policy; proposes tracked changes.

- Generates compliance checklists with due dates.

Impact

Fewer reworks · Faster compliance · Clear audit trail.

Sample Questions

- "Summarize this week's RBI circulars; what edits are required before quarter-end?"

- "Compare AML Clause 7.2 vs new SEBI guidance; propose tracked changes."

Credit Memo & Underwriting Drafting Copilot

Challenge

Manual underwriting summaries are slow and inconsistent.

Tathya Solution

- Drafts credit memos with financial spreads, covenants, KYC/KYB checks, and risk flags.

- Embeds citations from statements and filings.

Impact

Faster approvals · Higher consistency · Audit-ready documentation.

Sample Questions

- "Draft a credit memo for client ABC with 6-month risk profile and KYC gaps."

Customer 360 & Personalization

Challenge

Banks struggle with siloed customer data spread across savings, loans, cards, and digital channels. This prevents relationship managers and digital platforms from offering personalized experiences and cross-sell opportunities.

Solution (Tathya Platform)

360 Insight Engine

Ingests data from multiple banking systems, credit bureaus, and digital interactions to give a unified, real-time view of the customer.

Customer Life Cycle Management

Enables hyper-personalized offers, risk-based pricing, and customer lifecycle management.

Impact

50%

Faster loan/credit approvals with automated risk profiling.

40%

Increase in cross-sell / upsell conversions.

Millions

Saved by reducing customer churn and improving retention.

Fraud Detection & Risk Management

Banks face increasing fraud attempts across digital payments, cards, and online transactions. Tathya analyzes streams, behavioral signals and third-party intelligence to detect anomalies in real-time.

Challenge

Manual monitoring is too slow to detect anomalies in real time, leading to financial losses and reputational risk.

Solution (Tathya Platform)

Fraud & Risk Navigator

Uses AI to analyze transaction streams, customer behavior, biometrics, and third-party intelligence feeds.

Real-Time Alerts

Flags anomalies instantly and provides contextual explanations to compliance and risk teams.

Impact

45%

Reduction in fraud-related losses

70%

Faster detection & intervention

Millions

Saved in fraud claims & chargebacks

Regulatory Compliance & Reporting

Continuous mapping of regulatory updates and automated reporting to reduce errors and filing effort.

Challenge

Compliance teams must track evolving regulations; manual interpretation and reporting create errors, delays, and exposure to penalties.

Solution (Tathya Platform)

Regulatory Compliance Navigator

Continuously maps global regulatory updates to internal processes.

Automated Reporting

Automates compliance reporting for regulators, reducing manual effort and filing errors.

Impact

45%

Reduction in compliance filing errors

70%

Faster audit preparation

Millions

Saved in avoided penalties

PSUs & Government

Streamlining file management, circulars, and policy impact tracking across government organizations.

File-Noting & Circulars Copilot

Challenge

Large files and circulars move slowly; auditability and language variety are essential.

Tathya Solution

- Summarizes, drafts, and routes file-notings with audit trails and version lineage.

- Auto-translates and adapts tone for internal vs citizen-facing content.

Impact

60% faster note prep · Clear traceability · Consistent templates.

Sample Questions

- "Condense this 50-page file into a 3-minute brief with precedents and actions."

- "Turn this note into a citizen-facing circular in Hindi with the same citations."

Policy Impact & Program Outcomes Navigator

Challenge

Policies, tenders, inspections, and outcomes are scattered across systems.

Tathya Solution

- Links budgets/tenders/inspections/results into evidence-backed briefs.

- Surfaces impact KPIs with provenance.

Impact

Better oversight · Faster program adjustments · Fewer escalations.

Sample Questions

- "Which 2024 road-safety circulars are not fully implemented? Show by department."

- "Summarize outcomes for Program Y with references to audit and inspection reports."

RTI Response Drafting Copilot

Challenge

RTI responses must be accurate, complete, and consistent with law.

Tathya Solution

- Assembles RTI drafts with source citations, redactions, and legal clauses.

- Tracks approvals and versions.

Impact

Consistency · Faster response · Legal defensibility.

Sample Questions

- "Draft an RTI reply; attach data sources and confidence levels; mark redactions."

Healthcare & Pharma

Enhancing clinical decisions, patient care coordination, and regulatory compliance for healthcare providers and pharmaceutical companies.

Challenge

Pharmaceutical R&D teams face massive data overload with millions of research papers, trial reports, and ever-changing regulatory updates. This slows down discovery and increases compliance risks.

Solution (Tathya Platform)

R&D Insight Engine

Ingests research data, clinical trial results, and patents to give instant, contextual answers.

Regulatory Compliance Navigator

Streamlines approval by mapping global FDA, EMA, and PMDA requirements.

Impact

60%

Faster identification of viable compounds in pre-clinical stages.

40%

Reduction in regulatory filing errors.

Millions

Saved in compliance delays and rework.

Sample Questions

-

"Top-5 candidate compounds for target ABC with rationale and references?"

Literature & Trials Synthesis Copilot (R&D Insight Engine)

Challenge

Exploding volume of research, trials, and patents slows discovery.

Tathya Solution

- Unifies publications, patents, trials; returns context-rich answers with supporting evidence.

- Suggests plausible next experiments.

Impact

Faster candidate discovery · Reduced duplication · Higher R&D velocity.

Sample Questions

- "What were the primary outcomes of our Phase II trials vs competitor results?"

- "Top-5 candidate compounds for target ABC with rationale and references?"

Regulatory Dossier Navigator & Gap Analyzer (FDA/EMA/PMDA)

Challenge

Dossier assembly is error-prone and time-consuming.

Tathya Solution

- Maps current documents to Module requirements; flags gaps and drafts sections.

- Tracks lineage and citations for audit.

Impact

40% fewer filing errors · Faster submissions · Fewer regulator queries.

Sample Questions

- "Generate EMA Module safety section draft; include tables and citations."

- "Map new FDA AI/ML guidance to our SOPs; propose revisions."

Clinical Documentation & Case Summary Copilot

Challenge

Clinician time is scarce; documentation must be private and precise.

Tathya Solution

- Drafts case summaries from notes, labs, and images; applies privacy/PHI controls.

- Multilingual discharge briefs for patient comprehension.

Impact

Time back to clinicians · Better documentation quality · Safer handovers.

Sample Questions

- "Summarize this cardiology case in 1 page; include medication changes and follow-ups."

Point-of-Care Clinical Decision Support

Aggregate EHR notes, labs, vitals, meds, allergies, and guidelines to propose context-aware assessments and orders. Safety checks for renal dosing, allergies, and drug interactions with guideline citations.

Challenge

- Information overload across notes, labs, imaging, and guidelines.

- Time pressure reduces adherence to best-practice pathways.

- Siloed systems hide history and contraindications.

Tathya Solution

Clinical Insight Engine + Care Pathway Copilot

- Unify structured and unstructured data into a single patient context.

- Suggest differentials and orders with citations and safety checks.

- Provide one-click rationale and guideline excerpts at point of care.

Impact

Up to 30%

Reduction in avoidable variation in care.

15-25%

Improvement in time to diagnosis for complex cases.

Fewer

Medication errors and callbacks.

Sample Queries

- "Summarize this patient's CHF history and propose titration steps with citations."

- "Given eGFR 42, adjust antibiotic dosing and show supporting references."

Revenue Cycle and Coding Optimization

Challenge

- Documentation gaps lead to denials and under-coding.

- Coverage and pre-auth rules differ by payer and change frequently.

- Audits require time-consuming chart reviews.

Tathya Solution

Coding Copilot + Payer Policy Navigator

- Suggest codes from clinical context with line-by-line rationale.

- Flag missing documentation and pre-auth needs by payer and plan.

- Generate denial appeals with cited policies and clinical evidence.

Impact

2-4%

Lift in net patient revenue via accurate coding.

20-35%

Reduction in initial denials.

50%

Faster chart audits for high-risk claims.

Sample Queries

- "Recommend CPT and ICD-10 codes for this operative note and flag documentation gaps by payer."

- "Draft an appeal for denial code CO-50 citing medical necessity."

Aviation & Airports

Optimizing operations, maintenance, and safety across aviation and airport infrastructure.

Ops Control & Disruption Briefing Copilot

Challenge

ATC logs, NOTAMs, baggage, ground ops, and maintenance data must converge into timely action.

Tathya Solution

- Synthesizes feeds into operational briefs with alerts and mitigation playbooks.

- Tracks dependencies (slots, crews, gates).

Impact

Faster disruption response · Fewer cascading delays.

Sample Questions

- "Summarize all NOTAMs affecting runway 27 this week and operational impacts."

Runway/Tarmac Safety Intelligence Analyzer

Challenge

Incident media and reports must become clear safety actions.

Tathya Solution

- Analyzes visuals and logs; drafts safety briefs with root-cause hypotheses.

Impact

Clear corrective actions · Improved audit readiness.

Sample Questions

- "Draft a safety incident brief from ramp video + maintenance logs; list corrective actions."

A-Check / B-Check Work Package Builder

Challenge

Extracting maintenance tasks from AMM/IPC/SBs is tedious.

Tathya Solution

- Builds work packages with parts lists and downtimes; embeds citations.

Impact

Faster planning · Fewer missed steps.

Sample Questions

- "Create an A-check package from current SBs; list required parts and downtime."

Energy & Utilities

Ensuring asset reliability, predictive maintenance, and regulatory compliance in energy operations.

Grid Outage & Incident Analyst Copilot

Challenge

Operators need clear, defensible incident narratives and plans.

Tathya Solution

- Fuses logs/SCADA/reports; outputs 5-step mitigation plans with sources.

Impact

Shorter MTTR · Better cross-team coordination.

Sample Questions

- "Explain yesterday’s grid instability; provide a mitigation plan with references."

Asset Maintenance Briefs & Parts Planner

Challenge

Work orders and manuals are dispersed; context is lost.

Tathya Solution

- Generates asset briefs with fault history, critical spares, and risk.

Impact

Higher uptime · Right-first-time maintenance.

Sample Questions

- "Create a maintenance brief for transformer T-19—faults, critical spares, risk."

ESG & Safety Compliance Composer

Challenge

Evidence needs to be compiled rapidly and accurately.

Tathya Solution

- Assembles ESG and safety documents with traceable citations.

Impact

Fewer audit findings · Faster reporting cycles.

Sample Questions

- "Draft ESG scope-2 disclosure; cite meters, audits, and photos."

Manufacturing & Industry 4.0

Accelerating root cause analysis, predictive maintenance, and production efficiency with AI-driven insights.

Quality Copilot — Defect Narrative & Root-Cause Hypotheses

Challenge

Defects repeat when the story behind them isn’t clear.

Tathya Solution

- Builds defect narratives from QC sheets + images; proposes root-cause options.

Impact

Fewer defects · Faster line recovery.

Sample Questions

- "Summarize defect trends for line B last month; propose CAPA with expected impact."

Guided Work Instructions Generator (Visual/Multimodal)

Challenge

SOPs are long; execution needs visual guidance.

Tathya Solution

- Creates step-wise instructions with annotated visuals; multilingual.

Impact

Fewer errors · Faster training · Safer ops.

Sample Questions

- "Generate work instructions for assembly step 7 with annotated images."

Supplier Compliance & Specification Risk Analyzer

Challenge

Spec mismatches and contract gaps surface late.

Tathya Solution

- Compares spec sheets vs contract tolerances; flags risk gaps; drafts NCR/CAPA.

Impact

Stronger supplier governance · Less rework.

Sample Questions

- "Compare supplier specs vs contract tolerances; flag non-conformances and draft an NCR."

Predictive Maintenance & RCA Copilot

Challenge

Signals live across logs, manuals, and work orders; RCA is slow.

Tathya Solution

- Correlates signals with historical RCAs; proposes checks and spares lists.

Impact

Reduced downtime · Better parts planning.

Sample Questions

- "Surface repeat defects on machine M-42; list likely causes and recommended parts."

Manufacturing Industry

Challenge

Manufacturing teams face recurring machine and part failures that slow down production and increase downtime. Identifying the true root cause often requires piecing together data from sensors, maintenance logs, and quality records — a time-consuming and error-prone process.

Solution (Tathya Platform)

- Defect & Failure Analysis Copilot

Correlates IoT sensor data, maintenance notes, and past RCA reports to identify the most probable cause of failure. Recommends corrective actions, spare part replacements, and preventive steps based on historical learnings. - Predictive Maintenance Navigator

Predicts potential equipment breakdowns before they occur by analyzing vibration, temperature, and pressure anomalies. Provides early alerts and generates maintenance schedules to reduce unplanned stoppages.

Impact

55%

Faster root cause identification

40%

Reduction in unplanned downtime

Millions

Saved annually

Sample Queries

- "Analyze motor temperature and vibration trends to find likely failure cause."

- "List top 5 recurring defects in CNC machines this quarter and suggest preventive actions."

- "Draft a CAPA report for hydraulic pump seal failures with root-cause analysis and solution recommendations."

Telecom & Smart Infrastructure

Optimizing network operations, customer experience, and infrastructure management at scale.

NOC RCA Copilot — Alarm/Ticket/Topology Synthesis

Challenge

Alarm storms and ticket floods overwhelm teams; RCA quality varies.

Tathya Solution

- Summarizes alarms/tickets/topology changes; outputs RCA drafts with playbooks.

Impact

Faster RCA · Fewer repeats · Clearer communications.

Sample Questions

- "Explain the P1 outage root cause in 200 words with linked tickets and logs."

SLA & Vendor Performance Monitor

Challenge

Distributed vendors and contracts complicate accountability.

Tathya Solution

- Tracks SLA trends; composes renewal briefs with evidence.

Impact

Better negotiations · Predictable performance.

Sample Questions

- "Draft a renewal brief: vendor X SLA trend vs contract over 12 months."

Fraud Detection & Risk Management

Banks face increasing fraud attempts across digital payments, cards, and online transactions. Tathya analyzes streams, behavioral signals and third-party intelligence to detect anomalies in real-time.

Challenge

Manual monitoring is too slow to detect anomalies in real time, leading to financial losses and reputational risk.

Solution (Tathya Platform)

Fraud & Risk Navigator

Uses AI to analyze transaction streams, customer behavior, biometrics, and third-party intelligence feeds.

Real-Time Alerts

Flags anomalies instantly and provides contextual explanations to compliance and risk teams.

Impact

45%

Reduction in fraud-related losses

70%

Faster detection & intervention

Millions

Saved in fraud claims & chargebacks

Regulatory Compliance & Reporting

Continuous mapping of regulatory updates and automated reporting to reduce errors and filing effort.

Challenge

Compliance teams must track evolving regulations; manual interpretation and reporting create errors, delays, and exposure to penalties.

Solution (Tathya Platform)

Regulatory Compliance Navigator

Continuously maps global regulatory updates to internal processes.

Automated Reporting

Automates compliance reporting for regulators, reducing manual effort and filing errors.

Impact

45%

Reduction in compliance filing errors

70%

Faster audit preparation

Millions

Saved in avoided penalties

Manufacturing & Engineering (Aerospace, Aviation, Energy)

Dealing with equipment manuals, inspection reports, and operational data that require real-time processing and knowledge management for maintenance and operational efficiency.

Challenge

Manufacturing teams face recurring machine and part failures that slow down production and increase downtime. Identifying the true root cause often requires piecing together data from sensors, maintenance logs, and quality records — a time-consuming and error-prone process.

Solution (Tathya Platform)

Defect & Failure Analysis Copilot

Correlates IoT sensor data, maintenance notes, and past RCA reports to identify the most probable cause of failure. Recommends corrective actions, spare part replacements, and preventive steps based on historical learnings.

Predictive Maintenance Navigator

Predicts potential equipment breakdowns before they occur by analyzing vibration, temperature, and pressure anomalies. Provides early alerts and generates maintenance schedules to reduce unplanned stoppages.

Impact

55%

Faster root cause identification for recurring defects and machine failures.

40%

Reduction in unplanned downtime through early failure prediction.

Millions

Saved annually through improved asset uptime and reduced maintenance cost.

Sample Queries

- “Analyze motor temperature and vibration trends to find likely failure cause.”

- “List top 5 recurring defects in CNC machines this quarter and suggest preventive actions.”

- “Draft a CAPA report for hydraulic pump seal failures with root-cause analysis and solution recommendations.”

Point-of-Care Clinical Decision Support

Aggregate EHR notes, labs, vitals, meds, allergies, and guidelines to propose context-aware assessments and orders. Safety checks for renal dosing, allergies, and drug interactions with guideline citations.

Challenge

• Information overload across notes, labs, imaging, and guidelines.

• Time pressure reduces adherence to best-practice pathways.

• Siloed systems hide history and contraindications.

Solution (Tathya Platform)

Clinical Insight Engine + Care Pathway Copilot

- Unify structured and unstructured data into a single patient context.

- Suggest differentials and orders with citations and safety checks.

- Provide one-click rationale and guideline excerpts at point of care.

Impact

Up to 30%

Reduction in avoidable variation in care.

15-25%

Improvement in time to diagnosis for complex cases.

Fewer

Medication errors and callbacks.

Sample Queries

- Summarize this patient's CHF history and propose titration steps with citations.

- Given eGFR 42, adjust antibiotic dosing and show supporting references.

Revenue Cycle and Coding Optimization

Challenge

• Documentation gaps lead to denials and under-coding.

• Coverage and pre-auth rules differ by payer and change frequently.

• Audits require time-consuming chart reviews.

Solution (Tathya Platform)

Coding Copilot + Payer Policy Navigator

- Suggest codes from clinical context with line-by-line rationale.

- Flag missing documentation and pre-auth needs by payer and plan.

- Generate denial appeals with cited policies and clinical evidence.

Impact

2-4%

Lift in net patient revenue via accurate coding.

20-35%

Reduction in initial denials.

50%

Faster chart audits for high-risk claims.

Sample Queries

- Recommend CPT and ICD-10 codes for this operative note and flag documentation gaps by payer.

- Draft an appeal for denial code CO-50 citing medical necessity.

Healthcare Use Cases — Tathya Platform

Point-of-Care Clinical Decision Support

Aggregate EHR notes, labs, vitals, meds, allergies, and guidelines to propose context-aware assessments and orders. Safety checks for renal dosing, allergies, and drug interactions with guideline citations.

Challenge

• Information overload across notes, labs, imaging, and guidelines.

• Time pressure reduces adherence to best-practice pathways.

• Siloed systems hide history and contraindications.

Solution (Tathya Platform)

Clinical Insight Engine + Care Pathway Copilot

- Unify structured and unstructured data into a single patient context.

- Suggest differentials and orders with citations and safety checks.

- Provide one-click rationale and guideline excerpts at point of care.

Impact

Up to 30%

Reduction in avoidable variation in care.

15-25%

Improvement in time to diagnosis for complex cases.

Fewer

Medication errors and callbacks.

Sample Queries

- Summarize this patient's CHF history and propose titration steps with citations.

- Given eGFR 42, adjust antibiotic dosing and show supporting references.

Revenue Cycle and Coding Optimization

Challenge

• Documentation gaps lead to denials and under-coding.

• Coverage and pre-auth rules differ by payer and change frequently.

• Audits require time-consuming chart reviews.

Solution (Tathya Platform)

Coding Copilot + Payer Policy Navigator

- Suggest codes from clinical context with line-by-line rationale.

- Flag missing documentation and pre-auth needs by payer and plan.

- Generate denial appeals with cited policies and clinical evidence.

Impact

2-4%

Lift in net patient revenue via accurate coding.

20-35%

Reduction in initial denials.

50%

Faster chart audits for high-risk claims.

Sample Queries

- Recommend CPT and ICD-10 codes for this operative note and flag documentation gaps by payer.

- Draft an appeal for denial code CO-50 citing medical necessity.

PSUs & Government — Tathya Platform

File-Noting & Circulars Copilot

Challenge

Large files and circulars move slowly; auditability and language variety are essential.

Tathya Solution (Tathya Platform)

- Summarizes, drafts, and routes file-notings with audit trails and version lineage.

- Auto-translates and adapts tone for internal vs citizen-facing content.

Impact

60% faster note prep · Clear traceability · Consistent templates.

Sample Questions

- “Condense this 50-page file into a 3-minute brief with precedents and actions.”

- “Turn this note into a citizen-facing circular in Hindi with the same citations.”

Policy Impact & Program Outcomes Navigator

Challenge

Policies, tenders, inspections, and outcomes are scattered across systems.

Tathya Solution (Tathya Platform)

- Links budgets/tenders/inspections/results into evidence-backed briefs.

- Surfaces impact KPIs with provenance.

Impact

Better oversight · Faster program adjustments · Fewer escalations.

Sample Questions

- “Which 2024 road-safety circulars are not fully implemented? Show by department.”

- “Summarize outcomes for Program Y with references to audit and inspection reports.”